The Aelia Shipping Pricing Addon is now included in the Aelia Currency Switcher

We are pleased to announce that the Aelia Shipping Pricing plugin, originally distributed as a separate addon for the Aelia Currency Switcher, will been bundled with the main plugin starting from version 4.11.x of the Currency Switcher. We took the decision of merging the two plugins after reviewing our sale statistics. The vast majority of our customers use both plugins together, therefore it made sense to release them as a single product.

This new distribution model brings several advantages:

- Easier maintenance. The licence for the Currency Switcher covers both the main plugin and the addon, so you won’t have to remember to renew two of them.

- Easier updates. The Shipping Pricing addon will “follow” the Currency Switcher at every update, reducing the chance of issues caused by old versions that were not updated.

- Lower price. The Aelia Currency Switcher with the Shipping Pricing addon included is cheaper than the current price of the two separate plugins.

What this means for our customers

If you’re using the Aelia Currency Switcher with the Shipping Pricing Addon as a separate plugin, you will soon see a notice informing you that the addon has been bundled with the Currency Switcher. The notice will look like the following:

The plugin “Aelia Shipping Pricing for Currency Switcher” is now included with the Aelia Currency Switcher

This plugin is now included in the Aelia Currency Switcher and no longer has to be installed separately. You can go to the Plugins page, then disable and remove plugin “Aelia Shipping Pricing for Currency Switcher”. Its features will remain available, as they were before.

As indicated in the message, you will just have to go to WordPress Admin > Plugins and disable the Shipping Pricing Addon. The features originally provided by that plugin will remain available via the Currency Switcher, exactly as they were before.

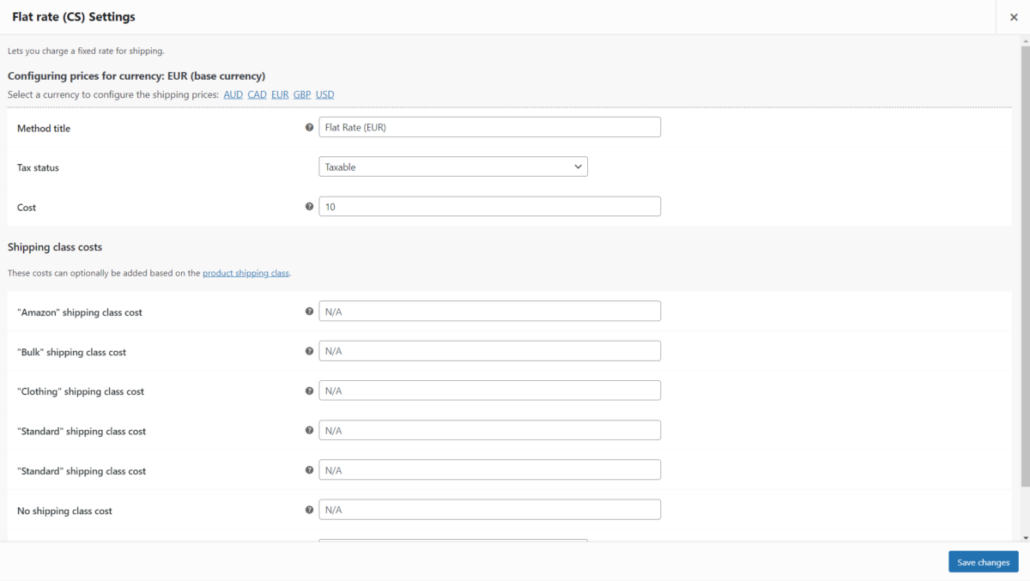

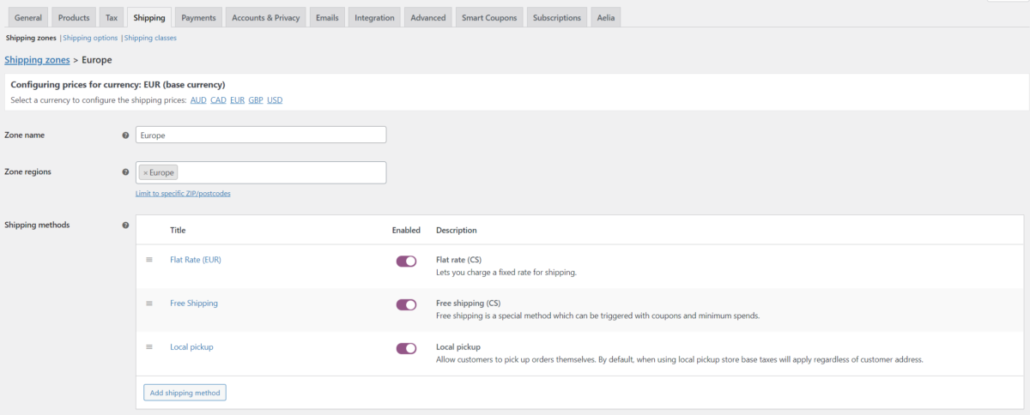

If you’re using only the Currency Switcher, you won’t have to do anything. You will just find the new features in the WooCommerce > Settings > Shipping page, after opening a shipping zone. Below you can find some screenshots of the Shipping Pricing Addon in action:

- The Shipping Method page now allows to enter prices in multiple currencies.

- The Shipping Zonepage now allows to choose the currency to enter the shipping costs.

How this affects your licences

Your licence for the Aelia Currency Switcher will allow you to download the new version, including the Shipping Pricing features, automatically. When the licence for the Shipping Pricing addon will expire, you will not have to do anything. In fact, you can simply delete the Shipping Pricing addon from your site after updating the Currency Switcher. As indicated, the main plugin now includes all the features from the shipping addon.

Any questions?

If you have any questions, please feel free to contact us, we ill be ready to assist you.

The Aelia Team